Welcome

coming soon...

Our website is launching soon. Come back and check it out.

Contact

Feel free to contact me with any questions, for more detailed information.

Looking forward talking to you.coming soon...

Daniel Huber

-CEO, CANVENA Consulting LLC | USA-

Contacts

d.huber@canvena-consulting.com

Mobile US: +1 (561) 884-2186

Address

CANVENA Consulting LLC

3119 Coral Way, STE 200

Miami, FL. 33145

USA

making trees investable

for positive impact

in every portfolio

creating win-win-win opportunities for investors, forestry partners and the planet

Trusted by private and institutional investors.

★★★★★

Mike Keul | CANVENA - COO

Michael Keul, a Munich-born entrepreneur and consultant with Canadian roots, serves as COO of Canvena since 2021, crafting efficient business models for executives and entrepreneurs while prioritizing practicality, integrity, and long-term trust. A nature lover, he enjoys outdoor activities and values health and family time with his wife and two children. From a hardworking background, he developed an innovative income-scaling model with partners, focusing on life quality and meaningful connections.

Florian Ehrbar | CANVENA - Advisory Board

Florian Ehrbar is a seasoned Web3 and startup veteran with 11 years of experience in management roles within tech startups before transitioning into the Web 3.0 space, where he founded OnchainLabs.ch Prior to this, he managed diverse investment strategies for a private Hong Kong family office, achieving notable success in developing complex custom blockchain software for executing specialized trading strategies and advanced data analysis. His expertise extends to evaluating startup companies for investment opportunities and forging global relationships with venture capital firms, establishing him as a key figure in bridging traditional finance with innovative blockchain technologies.

We are CANVENA

real people for real value world assets

Andrew Collins | CANVENA - Advisory Board

Andrew Collins, founder of Miro Forestry and its CEO for 16 years, is an expert in emerging market investments and forestry business development, drawing on his family forestry background and over five years of sector experience. Previously at Panmure Gordon & Co, he handled equity fundraising, mergers, and London Stock Exchange flotations. As a partner in Miro Holdings International Limited, he launched timber plantations, clean energy firms, and an African rice company. With a Masters in Engineering from Bristol and a Masters in Finance from Cranfield, Collins grew Miro into a leading sustainable forestry operation in sub-Saharan Africa.

Daniel Huber | CANVENA - CEO

Daniel Huber, CEO of CANVENA Ltd. and co-founder of Miro Forestry, brings over 22 years of expertise in business development, consulting, and innovative financing models, with a focus on tokenizing real assets to create sustainable liquidity. A specialist in asset management, he is pioneering the world’s first stablecoin backed by biologically growing trees, revolutionizing green investment financing. With 16 years of experience in commercial forestry and timber plantations, Huber holds a Master in Management from the University of Applied Science Mainz (2020) and a Bachelor of Arts (Hons) in Insurance and Finance from Wiesbaden Business School (2010), driving his mission to redefine capital raising through sustainable, asset-based solutions.

Baykal Colakoglu | CANVENA - CRO Business Development

Baykal Colakoglu serves as the Chief Revenue Officer and Business Developer at DEXPO.space, where he leads a skilled team of specialists in AI, blockchain technology, and tokenization, driving the platform’s mission to revolutionize digital innovation and decentralized interactions by empowering businesses and individuals with cutting-edge blockchain tools. Additionally, as a Senior Consultant in Cryptocurrency Forensics at Kerkhoff & Partner, Colakoglu brings expertise in navigating the complexities of digital assets, enhancing security and compliance in the crypto space. His dual roles highlight his leadership in advancing blockchain adoption and forensic analysis within the rapidly evolving decentralized ecosystem.

Phillip Henkel | CANVENA - CMO

Phillip Henkel is an experienced marketing professional with over 9 years in the creative industry. With a Diploma in Communication Design, he combines strategic marketing expertise with creative vision. Henkel honed his skills at renowned agencies BBDO and Thjnk, working on major brands including McDonald's, BMW, and IKEA and many more. As CMO, he specializes in brand development and integrated marketing strategies, bridging traditional and digital channels to create cohesive brand experiences across all potential touchpoints.

Daniel Tyoschitz | CANVENA - CRO

Daniel Tyoschitz is the Chief Growth Officer at CANVENA and a serial entrepreneur with a focus on lead generation and revenue operations. He previously co-founded a B2B SaaS company in the mobility sector, where he helped shape its growth and go-to-market strategy. Before that, he worked as an independent innovation advisor in Silicon Valley, Tel Aviv, and Berlin. In this role, he supported established corporations with digital transformation and corporate venturing initiatives. His career bridges the worlds of startups and enterprise innovation.

Our Partners

Our Fans

CANVENA, the European branch, leverages cutting-edge technology to empower forestry companies to unlock greater liquidity from their valuable biological assets.

In partnership with WebTech Industries, the technical branch in the United Arab Emirates, CANVENA developed DEXPO.space, a Metaverse and Web 4 platform that combines technology and sustainability, enabling companies and organizations to create virtual spaces to showcase products, services, and ideas.

CANVENA provides investors - regardless of investment size or time horizon - access to previously illiquid real-world assets (RWA) through tokenized investments, combining Swiss legal compliance with transparency and maximum security.

A flagship initiative, the Timber Token, is a blockchain-based, regulated investment structure that offers access to high-yield forestry assets. It is backed by fast-growing, certified forests and monetized carbon credits, functioning as a security-like instrument.

Through tokenization, CANVENA unlocks illiquid assets, offering qualified investors a scalable, income-generating vehicle with stable returns of approximately 15% p.a. from timber growth, while promoting CO₂ sequestration and biodiversity. Our social media consulting and onboarding strategies enhance visibility and streamline capital raising, ensuring profitability and positive community impact within the rapidly growing $38.19 trillion sustainable finance market by 2034 (CAGR 21.7–24.1%, Precedence Research).

About us

Sustainability

Canvena is deeply committed to sustainability and responsible corporate citizenship, integrating environmental and social impact into its core philosophy while delivering strong financial performance and innovative products.

Guided by comprehensive codes, policies, and assurance processes, Canvena prioritizes greener power solutions, minimized transport and freight, and circular economy principles, continuously striving for improvement.

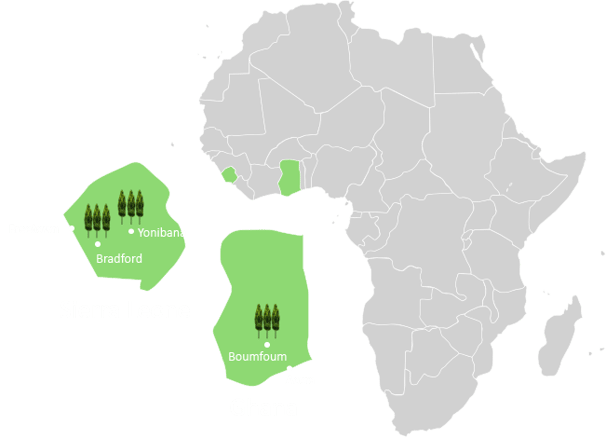

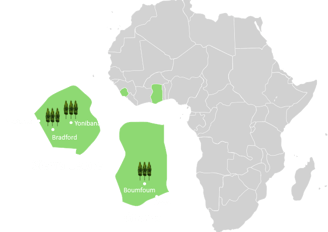

A cornerstone of its impact investment strategy is Miro Forestry, which sources wood from its own FSC™-certified plantations established on previously degraded land in sub-Saharan Africa, adhering to the highest social and environmental standards. Miro Forestry combines positive financial returns with significant contributions to the United Nations Sustainable Development Goals (SDGs), as highlighted in its 2023 annual report, fostering community well-being, CO₂ sequestration, and biodiversity.

Canvena’s flagship Timber Token, a blockchain-based, Swiss-regulated investment vehicle, further amplifies this impact by tokenising forestry assets, offering investors high risk-adjusted returns.

A tree is a

4-billion-years-perfectly-engineered growth machine.

If you take the biomass of the seedling

as the starting point,

you get a return of about

200,000 percent in 10 years.

4 billion years

200,000.00 %

perfectly engineered growth machine by nature

What is a tree?

value increase in 10 years

US$ 2 trillion

tokenizable timber assets

The best Part is

trees don’t read the Financial Times

Worldwide Potential

Digital Artdesign by Abi Daker: https://abidaker.com/

A tree is a

4-billion-years-perfectly-engineered growth machine.

If you take the biomass of the seedling

as the starting point,

you get a return of about

200,000 percent in 10 years.

4 billion years

200,000.00 %

perfectly engineered growth machine by nature

What is a tree?

value increase in 10 years

US$ 2 trillion

tokenizable timber assets

The best Part is

trees don’t read the Financial Times

Worldwide Potential

Digital Artdesign by Abi Daker: https://abidaker.com/

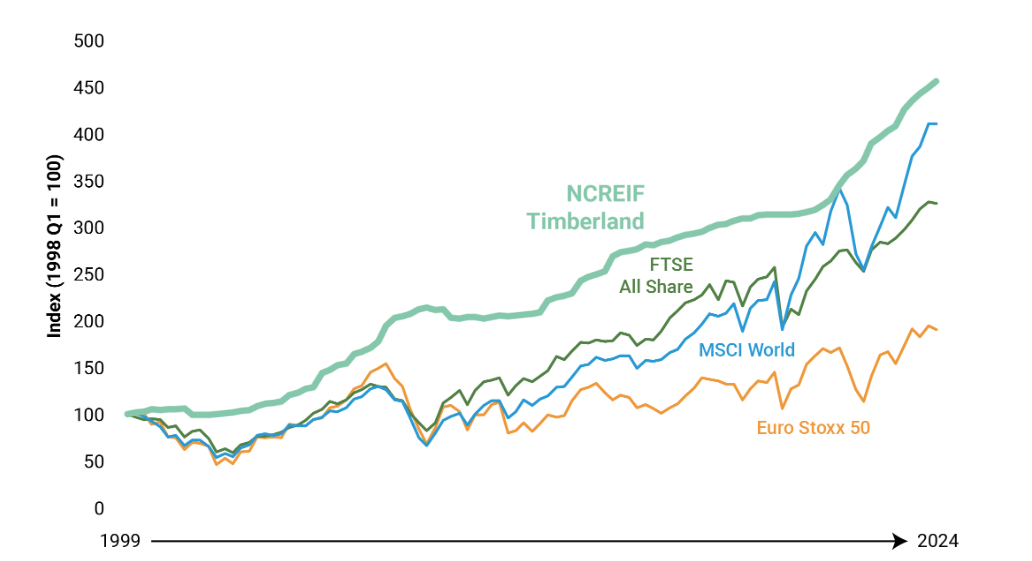

Elite endowments like Yale and Harvard have invested in timber for decades.

David Swensen, one of the best institutional portfolio managers allocated Timber to the Yale endowment portfolio.

Over the past 10 years, Swensen has achieved an average return of 17.2% anually with the Yale-Model.

Timber beats Stocks

by higher performance

Timber in an investment portfolio

Timber beats equity markets by performance and fixed income by lower volatility

Timber offers stable cash flows, biological growth, low correlation to equity markets and high correlation to inflation perfect for diversification in a portfolio.

YouTube Video Link: https://youtu.be/AtSlRK0SZoM?t=2942

Timber beats bonds

by lower drawdowns

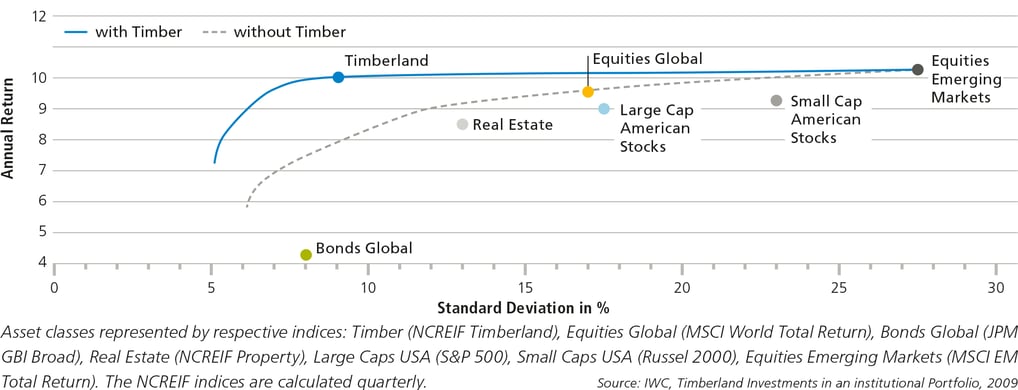

Efficient Frontier of an Institutional Portfolio

with and without Timberland

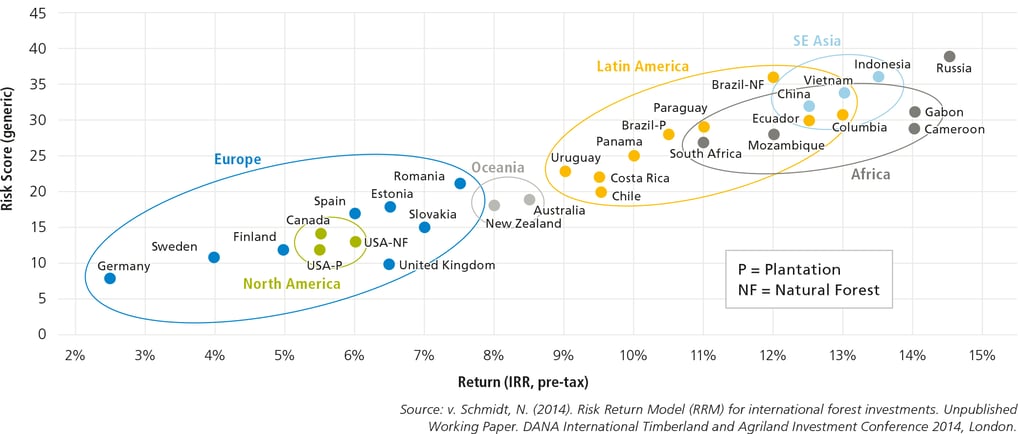

Risk-Return Profiles of Selected

Timber Investments

NCREIF Timberland Index compared to stock indices (1987–2024)

The various markets in which investments in timberland can be made are characterised by different risk-return profiles.

Investment opportunities in timber are diverse, offering options suitable for every portfolio. Europe and Latin America provide a wide range of risk-return profiles due to the numerous countries in these regions. Further geographic subdivisions, such as into Western and Eastern Europe or Central and South America, may be necessary to develop a tailored investment strategy. Oceania serves as a critical component for a globally diversified portfolio.

A 2009 study by the International Woodland Company (IWC) demonstrated that timberland investments can significantly reduce a portfolio's overall risk. Comparing two portfolios, one with and one without timber investments, shows that including timber increases returns while lowering risk, primarily due to timber's low or negative correlations with traditional asset classes. Historically, the NCREIF Timberland Index indicates low value fluctuations in forest investments, driven by stable biological growth, which has enabled consistent returns with a low volatility of just 8.5%. To assess loss risk, the frequency distribution of annual returns (TWRs) is crucial, alongside volatility. From Q1 1987 to Q3 2007, the Index recorded only three quarters with losses:

Q1 1987 (-0.06%), Q4 2000 (-0.45%), and Q4 2001 (-6.54%). More recent data highlights the Index’s continued resilience post-2007. For instance, a 2014 source reported a Q4 2013 return of 5.92%, the highest quarterly return since Q4 2007 (9.38%). Additionally, 2022 stood out with a 12.9% annual return, the largest since at least 2010, and a Q4 2022 return of 4.89%. These figures suggest a sustained low frequency of losses, consistent with the historical data from 1987–2007. However, no new specific quarterly loss data for the 1987–2007 period has emerged beyond the cited figures, as the NCREIF Timberland Index’s proprietary nature restricts public access to detailed breakdowns. For further granularity, direct consultation with NCREIF or access to their database may be necessary.

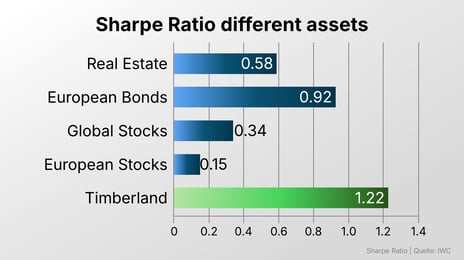

Risk-Reward Relation - Sharpe Ratios

The Sharpe Ratio measures the excess return above the risk-free interest rate per unit of risk of an investment. By relating the expected excess return to the volatility of returns, a quantitative statement about the risk-reward ratio can be made.

The higher the value, the better the risk-reward ratio. With a Sharpe Ratio of 1.22, timberland investments, as measured by the NCREIF, offered a very attractive risk-reward ratio, especially compared to stocks and bonds.

The Impact

$38B

Annual Need

To offset global deforestation

22M

4,300

Creating sustainable jobs

Across 21,000 hectares

Trees Planted

Workers Employeed

Miro Timber Token

Timber offers stable cash flows, biological growth, low correlation to equity markets and high correlation to inflation - perfect for diversification in a portfolio.

LOW ENTRY

Buy a fraction of a forest

for as little as $100 bugs.

LIQUIDITY

Purchase or sell MIRO Timber Tokens (MTT) simple anytime, anywhere.

SIMPLICITY

Buy & Pay via Paypal, etc. No exchange.

No Wallet. No Crypto account needed.

SINCE 2009 | FROM US$ 2M TO US$ 215M RAISED | 21,000HA FORESTRY | 22,000,000 TREES

4,300 EMPLOYEES FOR 30,000 LOCALS | 2 MILLS | US$ 275M - 390M MARKET VALUE

TILL TODAY

since 2009

from US$ 2M to US$ 215M

21,000ha forestry 21,000,000 trees

4,300 employees for 30,000 locals

2 mills

US$ 275M - 390M market value

VISION

from US$ 2M to US$ 215M

95,000ha forestry 250,000,000 trees

50,000 employees for 120,000 locals

10 mills

US$ 38B per year possible

To scale the numbers from a 21,000-hectare forestry operation to a 95,000-hectare operation, we assume a proportional relationship between the hectares and the provided metrics (trees, employees, locals, plywood mills, and valuation). The scaling factor is calculat

But timber was locked away for institutions. High entry costs, illiquidity, and decades-long commitments.

Until now.

With the Miro Timber Token, Canvena democratize timber investments:

Low entry: “Buy a fraction of a forest for as little as $100 bugs”.

Liquidity: Trade tokens everytime, everywhere

Let’s talk impact.

I am Co-Founder of Miro Forestry. We spent 180 Million from investors in 16 years planting 22 million trees across 21,000 hectares.

22 million trees planted across West Africa

180 Million raised to fund plantations

1.5 Million carbon credits sold Largest carbon credit issuer on the continent

Access structured through Canvena

Script:

This isn’t a concept. It’s a fully operational forest platform with over 22 million trees planted across Ghana and Sierra Leone.

It employs over 4,500 people and supports 30,000 lives.

Miro is also the largest producer of carbon credits on the African continent. 1.5 Million tons of carbon sequestered,

Through Canvena, we gained structured equity access to this platform – and now we are turning it into something investable.

Keep in mind The daily loss of rainforests amounts to 35,000 hectares in 24 hours!

Miro has managed to slow this destruction machine by 14.4 hours in 16 years of work.

Get in touch

Real people for direct contact and personal conversations.

Feel free to contact us.

Mobile US

+1 (561) 884-2186

hello@canvena-consulting.com

Canvena's commitment to sustainable investments has transformed my financial outlook. Their expertise in creating win-win partnerships is unmatched. Highly recommend their services!

John Doe

★★★★★

Investments

Smart partnerships for sustainable global opportunities.

Company

Stay updated

hello@canvena-consulting.com

CANVENA Consulting LLC

3119 Coral Way, STE 200

Miami, FL. 33145

USA

© 2025. All rights reserved.

e-mail: